Simulation Methods (FRM Part 1 2023 – Book 2 – Chapter 16)

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimited-package-for-frm-part-i-part-ii/

*AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams*

After completing this reading you should be able to:

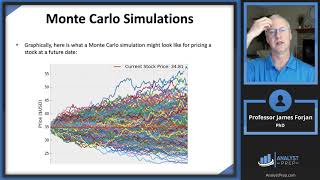

- Describe the basic steps to conduct a Monte Carlo simulation.

- Describe ways to reduce Monte Carlo sampling error.

- Explain how to use antithetic variate technique to reduce Monte Carlo sampling error.

- Explain how to use control variates to reduce Monte Carlo sampling error and when it is effective.

- Describe the benefits of reusing sets of random number draws across Monte Carlo experiments and how to reuse them.

- Describe the bootstrapping method and its advantage over Monte Carlo simulation.

- Describe the pseudo-random number generation method and how a good simulation design alleviates the effects the choice of the seed has on the properties of the generated series.

- Describe situations where the bootstrapping method is ineffective.

- Describe disadvantages of the simulation approach to financial problem solving.